www.industryemea.com

27

'20

Written on Modified on

Machine Vision in Industry

Machine vision technologies are evolving rapidly to keep pace with the requirements of industry, at times even surpassing them.

Author: Steed WEBZELL

Machine vision basically refers to image-based systems used in industrial and manufacturing tasks that include identification, inspection, sorting and gauging. These systems are also used for guidance in robotic applications. Vision-based technology has been in use for over four decades, though some devices were deployed even earlier. Keyence – today a leading global supplier of sensors, measuring systems, laser markers, microscopes and machine vision systems – started the development of general-purpose image processing systems in the early 1980s. Similarly, Automatix (now part of OMRON) demonstrated its Autovision II, a basic machine vision system, in 1983.

Broadly, three types of machine vision system have evolved over the years: 1D or line scan systems used mostly in continuous processes like sheet and rolled product manufacturing (paper, metal, etc); 2D machine vision with a digital camera to capture the image of an object, commonly deployed in barcode scanning and label orientation systems; and 3D machine vision systems with multiple cameras and laser displacement sensors, used typically in surface inspection and volume measurement. So what began as a very basic identification system has now been refined for use in very sophisticated devices that make use of emerging technologies like artificial intelligence (AI) and machine learning.

So what are the most recent developments in this field?

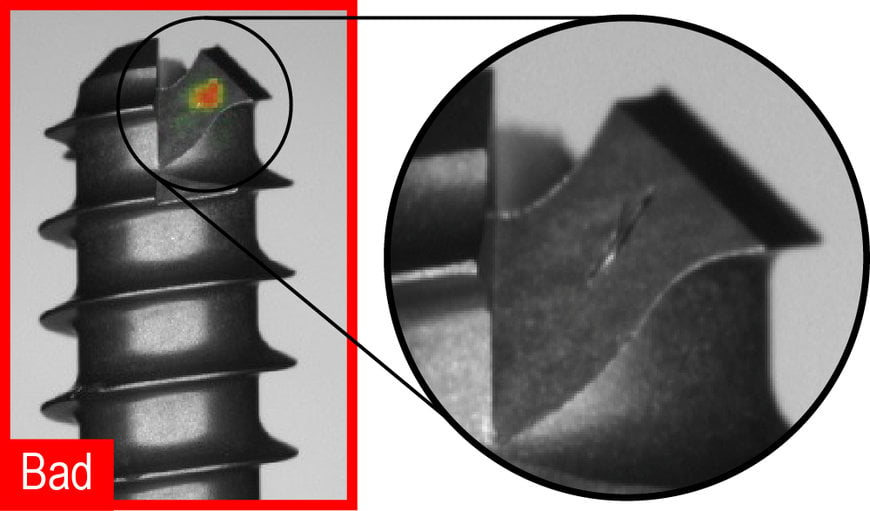

“The potential for machine vision inspection is growing rapidly due to developments in deep learning based strategies. Tasks that were very difficult or impossible to perform with state-of-the-art rules-based vision a few years ago are now possible using deep learning techniques. This has the potential to broaden our market significantly and replace millions of visual inspectors in coming years,” says Thierry Lelaure, VP of Sales (Europe) at Cognex.

The company applies machine vision to some of the most difficult in-line applications by global manufacturers of discrete products. “Our technology allows manufacturers to perform critical functions without making contact with the product or slowing down their production lines,” adds Lelaure. Common machine vision application examples from Cognex include guiding a robot to put a windshield in a car, aligning a screen on a smartphone, reading alphanumeric codes and barcodes on packages, gauging or measuring the width of an automotive brake pad, and inspecting electronic components for defects.

OMRON is counted among the globe’s biggest players in machine vision and industrial barcode scanning. “In order to enable manufacturers with 100% quality control, OMRON has been focusing on the development of an agile range of solutions that are truly flexible and adaptable. We have been experimenting with compact form factors for tight spaces, high-speed imaging for fast-moving production lines, high resolutions for detailed inspection, and power software platforms that could be fully integrated with not only our controllers and robotics systems, but with third-party devices,” informs Sameer Gandhi, Managing Director, OMRON Automation India. Gandhi draws attention to some of the recent and notable launches by OMRON: Industrial Ethernet smart cameras with expanded functionalities; smart cameras with the world’s first multi-colour light and high-resolution image sensors; PoE cameras with state-of-the-art CMOS sensors; and fast, flexible vision systems that feature industry’s first MDMC light for comprehensive defect detection.

Similarly, ISRA Vision is another international provider of machine vision solutions. Operating for over 35 years, the company offers high-performance components – in particular, high-resolution cameras and fast-switching LEDs – that enable the capture of structures in the nanometre and nanopixel range, even at extremely high speeds. The company’s focus and strengths have been in the development of advanced embedded technologies and complex algorithms in highly automated systems that include robot vision systems, as well as in-line measurement and inspection technologies. ISRA systems represent effective solutions that extend from process automation and product optimisation, through to product efficiency for industries which include automotive, composites, glass, metal, paper, plastic, packaging, printing and semiconductors, to list but a few. The company also serves the paper currency, passport and other security-critical documentation segment. ISRA provides inspection systems for quality control of the highly secure and complex features incorporated in modern banknotes. These tasks include distinguishing between the colours of security threads or performing the high-precision inspection of thread windows.

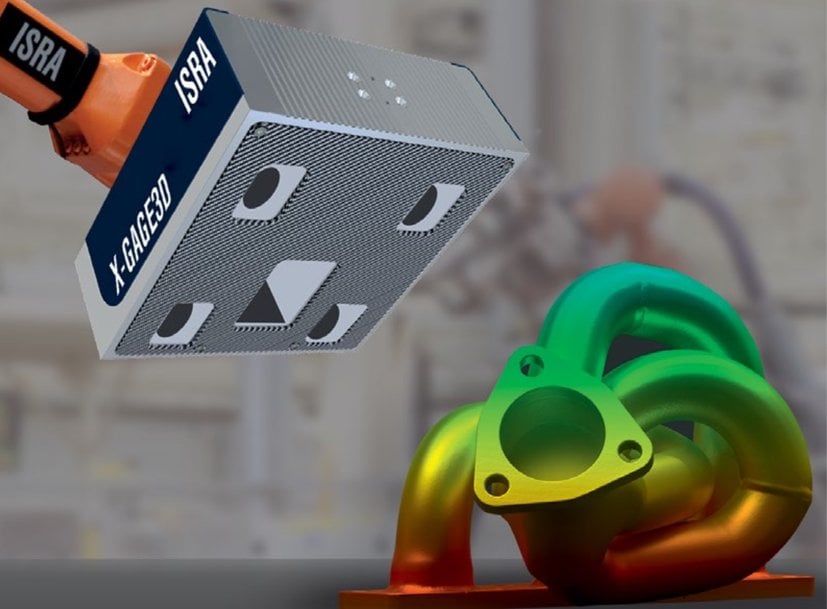

3D measuring in progress using the X-GAGE3D from ISRA Vision

Growth factors

According to MarketsandMarkets, a leading market research agency, the global machine vision market size was valued at USD 9.6 billion in 2020 and is projected to reach USD 13.0 billion by 2025. The major driver in the machine vision sector is the increasing need for quality inspection and automation. So what are the factors that will assist this growth over the next five years?

“Improved algorithms specifically tuned for accuracy, or performance gains in terms of inference times will help increase the adoption of machine vision in the near future. Also, cost reduction is a key motivator, since general purpose cameras with advanced software can now replace highly calibrated and expensive lighting and camera set-ups for the same roles when AI is used in machine vision,” says Jibin Rajan Varghese, Senior Systems Software Engineer at Nvidia, USA.

Varghese, who is passionate about computer vision and AI, also believes the rise of start-ups in this sector and their ease of access to graphic processing units (GPUs) and hardware-on-the-cloud for their computer and data-intensive training workloads, would impact positively on growth. “Inexpensive edge GPUs such as Jetson Nano, Xavier and Orin chips help further reduce the cost of deploying end-to-end solutions, which will spur growth in the machine vision market. This is in addition to generic industry-wide motivators for automating vision such as the push for Industry 4.0 and touchpoint reduction due to factors such as health concerns,” he says.

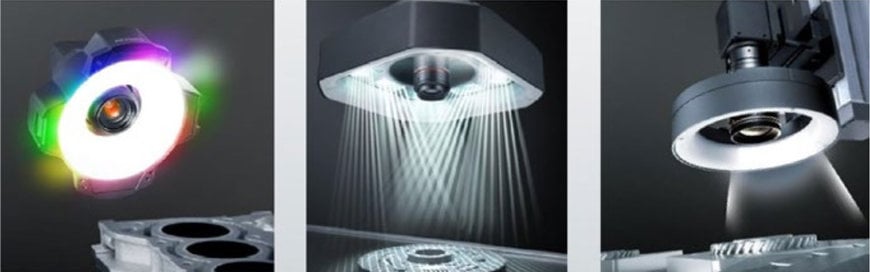

With reference to lighting, award-winning LED-based LumiTrax technology from Keyence has revolutionised machine vision with the fusion of high-speed cameras, intelligent lighting and a powerful algorithm. Finding a scratch or dent on the surface of an object, which is always difficult under certain lighting conditions, is now easily accomplished by capturing multiple images of an item with lighting from different directions. Using LEDs in eight different colours delivers high-performance, versatile lighting that can be used for multi-spectrum, LumiTrax or single-colour lighting that is four times brighter than conventional solutions.

LED lighting solutions from Keyence

According to Thierry Lelaure of Cognex, there are several macro-trends driving the future adoption of machine vision. The first is rising wages, which are increasing faster than productivity. There is also a desire for quicker throughput and an ever-increasing emphasis on quality. Another aspect is traceability due to concerns about product counterfeiting. Next, products and their components are getting smaller and smaller. “A similar dynamic exists in our own machine vision products, which like all technologies, are becoming more compact, less expensive, more powerful, and easier to use and integrate,” says Lelaure, alluding to factors that are driving growth in this segment.

AI in vision systems

The potential of AI in machine vision is just being tapped, even though all leading players are already offering products using this advanced technology. Imaging Development Systems GmbH (IDS), founded in 1997, started as a manufacturer of analogue frame grabbers – used for the capture of high-resolution images in high-end vision systems – but started making digital industrial cameras in 2004. Today, IDS is known for its range of cameras – uEye, IDS NXT and Ensenso 3D – as well as its software suites, which can be found in a wide range of machine vision applications within the automotive, packaging and printing industries, and in solutions for robotics, medical technology, traffic monitoring, security, kiosk systems and logistics. The IDS NXT is a vision app-based platform with AI that offers unlimited possibilities for future applications.

More recently, in July 2020, OMRON released its new FH series vision system with what the company claims is the industry’s first defect detection AI technology that identifies defects without learning samples. This AI technology, which reproduces human sensibility and the techniques of skilled inspectors, reliably detects defects that were once difficult to capture, thus automating inspection routines that were previously based on human vision.

OMRON Code Reader

With the 2019 acquisition of Korean company SUALAB, Cognex gained access to considerable intellectual property (IP), engineering expertise and market coverage in the area of AI and deep learning-based vision inspection. “The acquisition of SUALAB accelerates the opportunity for Cognex to solve challenging inspection applications in factories, which [until now] could only be done by large teams of human inspectors. Additionally, SUALAB expands Cognex’s presence in Asia, which is the world’s largest and fastest-growing market for deep learning-based vision,” says Lelaure. The addition of SUALAB’s engineering team and IP significantly enhances Cognex’s existing deep learning capabilities, which were acquired from ViDi Systems in 2017. “We now have the world’s largest team of highly skilled AI and deep learning engineers specialising in industrial machine vision applications. This special domain knowledge provides immense value to Cognex in one of our fastest-growing markets,” he says.

In late 2019, Keyence released the new IV2 vision sensor series, which utilises AI, continuing the company’s trend of developing innovative new technology paired with ultimate usability. The AI learning algorithm means the system can be simply ‘taught’ using images of good and bad parts, with no vision programming knowledge necessary for stable results. The AI algorithm accounts for variations in lighting and batch size, and even oily or dirty components, greatly boosting the efficacy of automated inspection.

As mentioned at the beginning, machine vision is not new, but the application of emerging technologies like AI and deep learning, coupled with advanced data analytics, is providing a rapid revolution.

Machine vision and Industry 4.0

What trends are emerging in machine vision applications due to greater adoption of Industry 4.0? “New trends include the need for more turnkey vision solutions and increased tolerance to variable lighting conditions, as well as object shape and orientation. Bin picking in the e-commerce sector is gaining a lot of traction, with companies such as Vicarious AI and projects like the Amazon Picking Challenge fuelling the adoption of complex machine vision applications that are integral to Industry 4.0,” says Jibin Rajan Varghese of Nvidia.

To OMRON’s Sameer Gandhi, Industry 4.0 envisages a shop floor with intelligent and integrated devices. “A key trend here is the integration of machine vision devices – whether quality inspection or barcode reading – with other systems like robots and PLCs. Such integrated devices deliver powerful solutions that include traceability, robots with vision for superior and random pick-and-place and alignment, and 3D bin picking. To achieve these solutions, integration is key. That is why OMRON, with its wide product portfolio, is able to provide standard integrated solutions to meet the industry’s IIoT needs,” he says.

“Manufacturers want easy access to data collected from the factory floor,” states Lelaure. Cognex vision systems are used in the production of over 2 billion products a day, capturing and analysing multiple digital images of each one. “We are focused on connecting our vision systems to help customers access this data in real time. This ensures they can make more informed decisions and assist with things like predictive maintenance, remote monitoring and device management,” he adds.

The design of systems produced by ISRA Vision is based on an IT architecture that is ready for use in the emerging Industry 4.0 environment. The X-GAGE3D, for example, is equipped with four high-resolution cameras and a powerful LED that scans all object shapes quickly, even under challenging conditions. Armed with integrated computing capacity, WLAN and OPC/UA communication protocols, an ISRA robot vision system, and in-line measurement and inspection technology, the X-GAGE3D is ready for use in networked production conditions.

COVID-19 compulsions

The COVID-19 pandemic, which hit the world in early 2020, has caused massive disruption in the global economy, crippling manufacturing operations in most countries. This has lent fresh impetus to automaton and robotics, with conventional return on investment (ROI) calculations turned upside down. So how is the impact of COVID-19 likely to shape trends in machine vision?

According to Varghese, with more emphasis placed on social distancing and the containment of COVID-19, the industry has shifted more focus to manpower reduction, especially in the manufacturing and warehousing/logistics sectors. “There is also an ongoing effort by major companies such as Amazon and Walmart to reduce human touchpoints in their logistics division, in order to reduce liability. This has fuelled demand for automated sorting and packaging tasks, which in turn will increase the adoption of machine vision in the upcoming half of the year,” he says.

This view is seconded by Lelaure, who says: “Manufacturers are increasingly interested in how robotics and automation can help their business, both from a production and workforce augmentation standpoint. Machine vision is an efficient and effective way for manufacturers to automate processes such as visual inspection and defect detection. E-commerce was one of the fastest growing markets for machine vision before the pandemic. Demand in this market is increasing even quicker now due to social distancing, as consumers are ordering more goods online to avoid shopping in-person. As a result, e-retailers are leveraging technology to help them be as efficient as possible in their distribution efforts. Many companies are also looking to become more flexible and agile with the packaging of products so they can go straight-to-consumer, because there isn’t time for products to be tied up in the logistics chain.”

Gandhi adds: “The post-COVID world has started to shape consumer demands and behaviour. The consumer is more-than-ever conscious and demanding about quality and hygiene. This is likely to put greater demand on manufacturers to control and enhance quality by ensuring that products of poor standard are not shipped, and the entire supply and delivery chain is tracked using advanced traceability solutions. All this is possible with machine vision alone. It’s the key to achieving global standards in quality, consistency and reliability, along with hygiene. The reboot and reset triggered by COVID-19 is the right opportunity for manufacturers to invest in machine vision.”

In conclusion, machine vision technologies are evolving rapidly to keep pace with the requirements of industry, at times even surpassing them. The systems are getting faster to match ever-increasing production rates, while simultaneously becoming more affordable. Machine vision is also getting more intuitive and easy to use, with plug and play options. In addition, with the help of emerging technologies, machine vision is gaining intelligence to deal with flexible production schedules and other process variations. The human eye now has serious competition.

Bin picking using a vision-enabled mobile collaborative robot (cobot) solution devised by OMRON

Cognex reports that machine vision is an efficient and effective way for manufacturers to automate processes such as defect detection