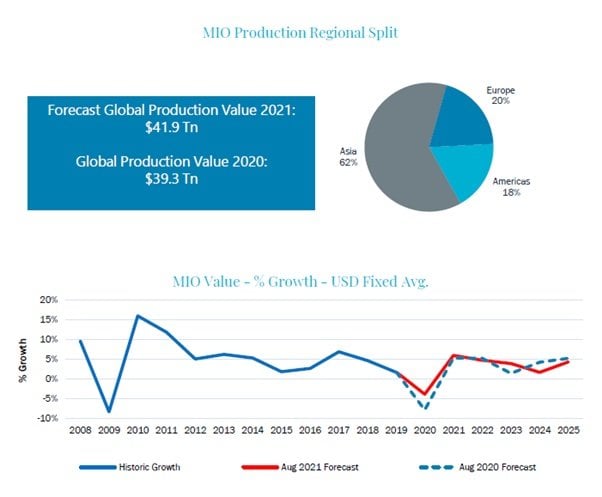

Global manufacturing industry output to hit $41.9 Tn in 2021, up from $39.3 Tn in 2020

Market intelligence firm Interact Analysis has released the latest update of the global Manufacturing Industry Output Tracker (MIO). The research shows that recovery in 2021 will be muted, following a far smaller contraction in 2020 than had initially been predicted.

- Manufacturing output set for slow 2021 recovery, after unexpectedly small 2020 contraction

- Freight shipping costs increased 5-fold over the past year

- Semiconductor and electronics machinery market grew 8% during 2020

Meanwhile, the ongoing semiconductor shortage, coupled with the continued spread of the delta variant, rising freight costs, and growing worker shortages; will create ongoing problems for all manufacturers.

The semiconductor shortage can be attributed to several factors, but the biggest impact comes from the automotive industry. As automotive manufacturers scaled back production in preparation for an expected collapse in demand for vehicles, they reduced their orders for microchips. But the automotive slow-down was not as severe as had been feared, leaving vehicle factories unable to meet demand because their stocks of semiconductors were depleted. Demand for semiconductors then boomed as car factories suddenly ramped up orders, and now Interact Analysis predicts that the semiconductor market will suffer a steep dip in 2023 as the supply situation normalizes.

Rising freight rates have also significantly impacted the manufacturing sector. And the cost of shipping a 40-foot container from China to the US east coast in July 2021 increased by 5 times compared to July 2020, reaching a high of $20,000. There are multiple reasons for this, including staff shortages, saturated ports, soaring demand in certain sectors such as electronics, and delta variant outbreaks. With no end in sight to inflated freight rates, manufacturers are likely to look for solutions that are closer to home in the long run.

The global machinery market took a damaging hit during the pandemic as factories cut back on investment, with the hardest hit sector being machine tools, which slumped by 18% in 2020 in the face of the knock-on effects of a decline in investment from automotive and aerospace customers. However, many machinery sectors fared better, with the market for semiconductor and electronics machinery growing by 8% in 2020. By 2025, all manufacturing sectors will have recovered to 2019 levels, and some segments, such as the metallurgy machinery market, will reach the 2019 mark this year.

Adrian Lloyd, CEO at Interact Analysis says: “It is encouraging to know that the global machinery market, which is currently worth $1.98 trillion, will increase to $2.11 trillion in 2021. And, while short-term machinery growth will be patchy, and highly sector dependent, I do believe that the pandemic has provided an important long-term boost for machine builders. The reason being that the experience of having to cope with large numbers of workers needing to social distance and self-isolate in 2020 has caused many manufacturers to look at how they will cope with similar events in future, and industrial automation clearly offers an important solution for companies trying to respond to these problems.”

“Interestingly, we also predict non-manufacturing machinery segments to achieve a CAGR of 3 to 4% between 2021 and 2025, of which the mining and farming machinery markets will achieve the highest growth of 5.3% and 5.1% respectively.”

www.interactanalysis.com